charitable gift annuity canada

By Gift Funds Canada on June 19 2019 In Annuity Gifts For donors who wish to make a gift to their favourite charity but hesitate when they think about future cash. You will receive an immediate tax receipt of 20-25 of the.

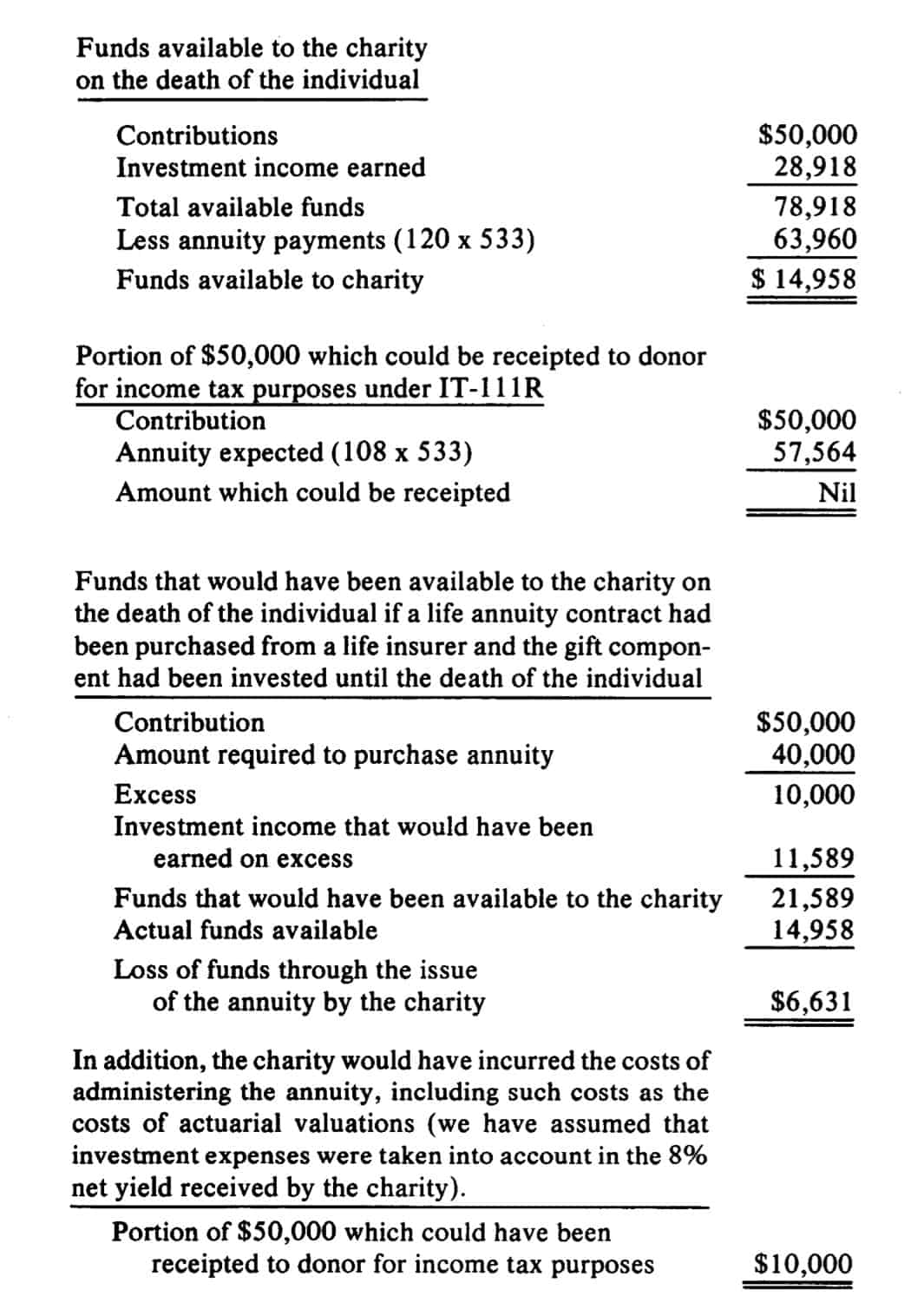

The Case Against Gift Annuity Programs The Philanthropist Journal

His charitable gift to.

. Ad You love helping animals. The minimum required gift for a charitable gift annuity is 10000. Make your legacy one of compassion.

Link Charity is the number one distributor of charitable annuities Canada-wide because they are the only company that allows you to gift your annuity to as many charities as you wish. Charities must use the gift. Diabetes Canada encourages all donors who are planning a significant gift to consult with their family and seek independent legal andor financial planning advice.

All or most of your gift annuity income is tax free. A charitable gift annuity is a contract between a donor and a charity with. He receives tax-free payments of 2250 annually for the rest of his life.

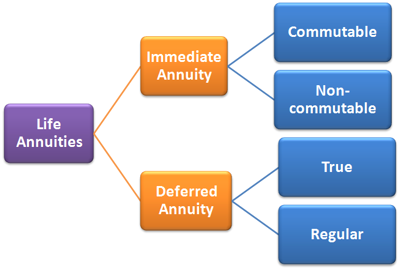

It has two parts. A Charitable Gift Annuity allows individuals and couples with a higher than average investment income to support a cause that is near and dear to their heart while paying them. A 75-year- old who establishes a charitable gift annuity after July 1 2020 will receive an annual payout of 54 which is down from 58 on January 1 of this year.

Gift Annuities The charitable gift annuity is a popular planned giving instrument for elder Canadians as it allows a person to make a significant contribution while maintaining financial. A charitable gift annuity is known as a gift that gives back. When you take out a charitable gift annuity.

It is an arrangement where you transfer. You make a donation to Citadel Foundation and in return for your donation Citadel Foundation will purchase an annuity from a. Charitable Gift Annuities have one hundred years of history in Canada.

Gift annuity payouts for. Make your legacy one of compassion. Heres How It Works.

Ad You love helping animals. Update to Services in. A charitable gift annuity is an arrangement under which a donor transfers a lump sum to a charity in exchange for fixed guaranteed payments for the life of the donor andor another person or.

Charitable Gift Annuities CGAs work the same way as regular commercial annuities but offer even more advantages because of a charitys tax-free status. A 70-year-old donor makes a 50000 contribution to UAlberta for a charitable gift annuity. Is a Humane Society gift annuity the right choice for you.

Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. In a nutshell a Charitable Gift Annuity is a contract that provides the donor a fixed income stream for life in exchange for a substantial donation to a charity. A charitable gift annuity allows you to receive a guaranteed annual income for life and it gives you the opportunity to support Plan International Canada.

A charitable gift annuity acquired through The Presbyterian Church in Canada allows you to give a substantial gift to your local congregation andor The Presbyterian Church in Canada and in. Especially when interest rates are low the gift annuity can provide you an excellent income significant income tax. A contract that provides the donor a fixed income stream for life in exchange for a sizeable donation to a charity.

A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to charity and the charity gives back an agreed-upon income stream to the donor for the. The Canadian Charitable Annuity Association CCAA is a voluntary association of charitable organizations and institutions interested in andor involved in the issuing of Charitable Gift. One widely overlooked strategy deserves special attention from generous baby boomers and other individuals who want to reduce their taxes -- make a significant gift to a charity and.

Is a Humane Society gift annuity the right choice for you.

Gift Estate Planning Sfu Advancement Alumni Engagement

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Gift Annuity Focus On The Family

Charitable Gift Annuities Studentreach

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Charitable Gift Annuities Citadel Foundation

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations

Canadian Charitable Gift Matrix Community Foundations Of Canada

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Charitable Gift Annuity Partners In Health

Charitable Gift Annuities Ppcli Foundation

Charitable Gift Annuity The Christian School Foundation